Direct Materials Efficiency Variance Managerial Accounting

They train the employees to put two tablespoons of butter on each bag of popcorn, so total butter usage is based on the number of bags of popcorn sold. Therefore, if the theater sells 300 bags of popcorn with two tablespoons of butter on each, the total amount of butter that should be used is \(600\) tablespoons. Management can then compare the predicted use of \(600\) tablespoons of butter to the actual amount used. If the actual usage of butter was less than \(600\), customers may not be happy, because they may feel that they did not get enough butter.

Purpose of standard costs LO1

Learn how to calculate, analyze, and apply direct material variance for effective cost control and improved financial performance. This shows that we saved money by buying cheaper, but lost money because of material waste. It could be that the cheaper lumber has more knots, therefore forcing workers to throw more of the raw materials in the scrap heap. The responsible managers (e.g. purchasing and production) will have to get together to do more observations and research.

How is the direct material quantity variance calculated?

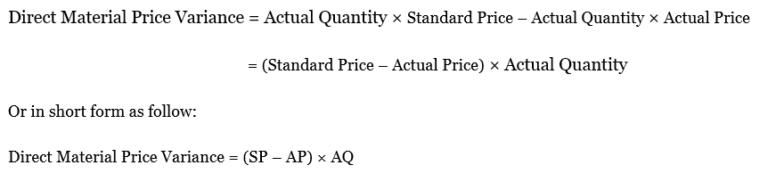

Direct material quantity variance is calculated to determine the efficiency of the production department in converting raw material to finished goods. In order to improve efficiency, wastage of raw material must be reduced. A negative value of direct material quantity variance is generally unfavorable and it implies that more quantity of direct material has been used in the production process than actually needed. A positive value of direct material quantity variance is favorable implying that raw material was efficiently converted to finished goods. Direct material price variance is the difference between what was actually spent on the raw materials purchased during a period and the standard cost that would apply if the materials were bought at the standard rate. To calculate the variance, we multiply the actual purchase volume by the standard and actual price difference.

- However, the company purchased 30,000 pounds of paper (the actual quantity), paying $9.90 per case (the actual price).

- It is important to note that cost standards are established before the work is started.

- The organization spent $135,000 for the direct labor hours that exceeded the standard number of hours allowed.

- Direct material price variance is the difference between actual cost of direct material and the standard cost.

- The standard quantity allowed of 630,000 feet is subtracted from the actual quantity purchased and used of 600,000 feet, yielding a variance of 30,000 feet.

- In such cases, the responsibility of any unfavorable quantity variance would lie on the purchasing department.

How is direct material usage variance calculated in a multi-product company?

Beta Company processes three materials, namely, material A, material B, and material C, to produce its only product known as product K. This product is produced in powder form and packed into bags before it is shipped to customers and wholesalers. Using the materials-related information given below, calculate the material variances for XYZ company for the month of October. Direct materials volume variance is the difference arising from using more (or less) than the predetermined amount on a product.

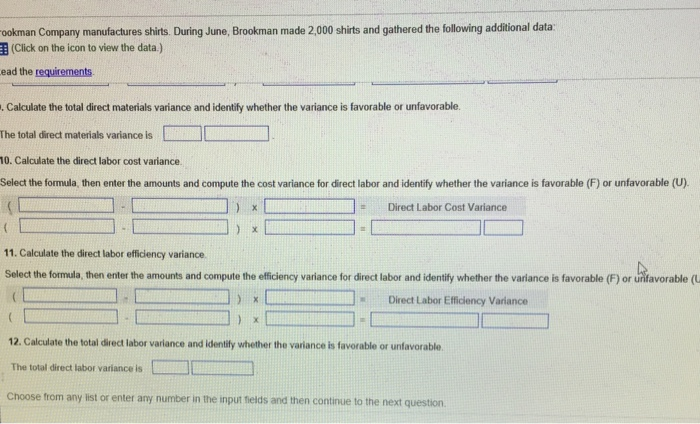

Standard costs and quantities are established for each type of direct labor. These standards are compared to the actual number of direct labor hours worked and the actual rate paid for each type of direct labor. When discussing direct labor, price is referred to as rate, and quantity is referred to as efficiency. Variances between the standard and actual amounts are caused by a difference in efficiency or rate. The total direct labor variance is separated into the direct labor efficiency and direct labor rate variances. A favorable direct material yield variance means a higher production than the standard or expected production based on the standard input quantities of materials.

Great! The Financial Professional Will Get Back To You Soon.

The total direct materials variance is calculated as the total standard costs allowed for direct materials of $315,000 less the actual amount paid of $330,000 equal the total direct materials variance of $(15,000) U. If a company’s actual quantity used exceeds the standard allowed, then the direct materials quantity variance will be unfavorable. This means that the company has utilized more materials than expected and may have paid extra in materials cost. In this case, the actual price per unit of materials is $6.00, the standard price per unit of materials is $7.00, and the actual quantity purchased is 20 pounds. This is a favorable outcome because the actual price for materials was less than the standard price. As you’ve learned, direct materials are those materials used in the production of goods that are easily traceable and are a major component of the product.

The standard quantity of 420,000 pounds is the quantity ofmaterials allowed given actual production. For Jerry’s Ice Cream,the standard quantity of materials per unit of production is 2pounds per unit. Thus the standard quantity (SQ) of 420,000 poundsis 2 pounds per unit × 210,000 units produced and sold. A favorable materials quantity variance indicates savings in the use of direct materials.

The standard variable manufacturing overhead rate is $3 per direct labor hour. Each unit should require 0.25 direct labor hours for total variable manufacturing overhead costs per unit of $0.75. It is important to note that cost standards are established direct materials variance formula before the work is started. Production managers are responsible for controlling costs and meeting the target cost, which is $7.35 per unit in this case. These thin margins are the reason autosuppliers examine direct materials variances so carefully.

When discussing variable manufacturing overhead, price is referred to as rate, and quantity is referred to as efficiency. These standards are compared to the actual quantities used and the actual rate paid for variable manufacturing overhead using the same processes applied in previous sections to analyze direct materials and direct labor. Any variance between the standard costs allowed and the actual costs incurred is caused by a difference in efficiency or a difference in rate. The total variance for variable manufacturing overhead is separated into the variable manufacturing overhead efficiency variance and the variable manufacturing overhead rate variance. The total variances can be calculated in the last line of the top section of the template by subtracting the actual amounts from the standard amounts projected. The standard quantity allowed is 37,500 hours less the actual hours worked of 45,000 hours equals a variance of (7,500) direct labor hours.

Inefficient use of the cost driver used to apply variable manufacturing overhead typically results in additional overhead costs. If the total actual cost is higher than the total standard cost, the variance is unfavorable since the company paid more than what it expected to pay. If the total actual cost incurred is less than the total standard cost, the variance is favorable.

Understanding direct material variance is crucial for businesses aiming to maintain cost efficiency and improve profitability. This concept involves examining the differences between expected and actual costs of materials used in production, providing insights into potential areas for financial improvement. A template to compute the standard cost variances related to direct material, direct labor, and variable manufacturing overhead is presented in Exhibit 8-11. Standards for variable manufacturing costs include both quantity and price standards. The quantity standard establishes how much of an input is needed to make a product or provide a service.