What is actually Paying? Putting Currency to be effective Beginner’s Publication

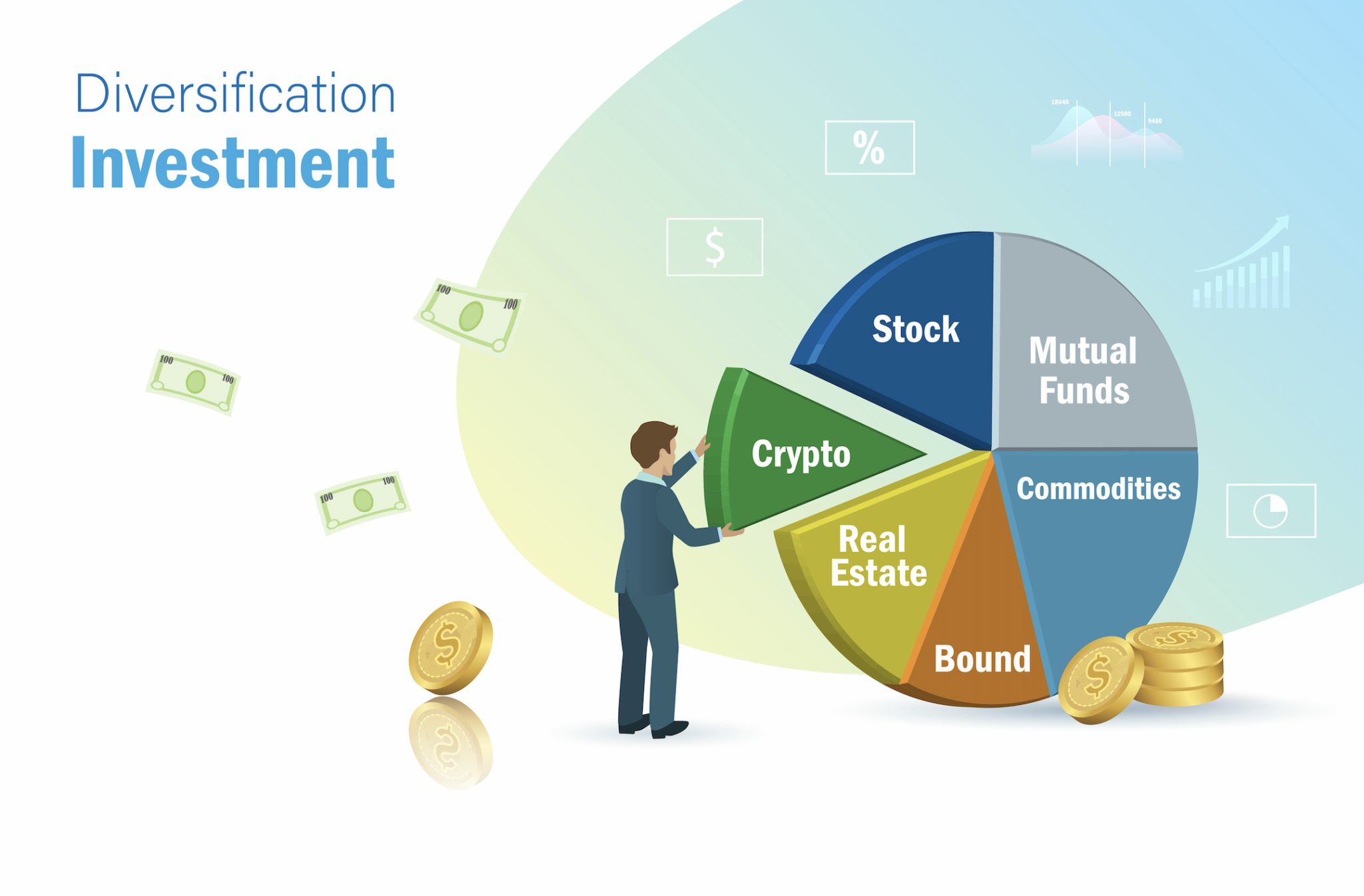

Such, you could get a financial otherwise funding coach or have fun with a great robo-advisor to design and apply a financial investment method in your stead. Founded inside 1993, The new Motley Deceive is an economic characteristics business dedicated to and make the world smarter, happy, and you can richer. Diversity combines many different assets, such as carries, bonds, or a house, in this a portfolio to minimize profile exposure. All the opportunities have some amount of exposure and also the market is unstable, it movements top to bottom over the years. It is important on how to discover your risk threshold.

It’s a critical grounds of one’s price-to-publication ratio, because of it showing the actual payment to have tangible property and you will maybe not more difficult valuation out of intangibles. Accordingly, the newest P/B was felt a comparatively old-fashioned metric. In early 1900s, purchasers away from stocks, ties, or other bonds were revealed within the media, academia, and you may business since the investors. In the finance, the goal of paying is to make money on the invested resource. The fresh get back get consist of a money obtain (profit) or losses, realized in case your investment is sold, unrealised financing love (or decline) when the yet unsold.

Which type of funding would you like to become familiar with?

A shared fund is a type of financing where more than one buyer pools their money together to buy securities. Mutual finance commonly necessarily couch potato, as they are handled by portfolio executives which allocate and you may spread the newest pooled investment to the carries, ties, or other ties. Very common fund has the very least money from anywhere between $500 and you will $5,100, https://startupmafia.eu/why-online-gambling-software-is-key-to-todays-casino-experience and some do not have one minimal at all. Actually a relatively brief investment will bring experience of as much as one hundred some other stocks contains in this a given fund’s portfolio. There are even mutual finance you to purchase exclusively in the businesses that follow certain moral otherwise environment prices (aka socially in charge finance). Because of their protected, repaired costs away from get back, bonds are known as fixed-income investments and are safer than holds.

We do not include the world from businesses otherwise financial offers which is often on the market. Also referred to as practical paying, it’s a method that needs romantic market investigation and you may desire to the current situations to see which carries can be undervalued. Often versus deal-hunting – taking a set of boots which have a keen 80% discount. An important benefits and you may advantages of ETFs is diversity, lower costs, the option to purchase more alternative assets, and is also as well as more tax successful.

Especially, shared fund or ETFs are a good 1st step, prior to moving on so you can personal stocks, a property, or other option investments. Bins out of opportunities such as shared fund and you can ETFs can help build resource allowance and you will diversification easier because they include a made-in the mix of assets already. You could mix some varied fund to discover the overall blend you need—even though the greatest services could be to favor an individual money that is aligned to your wants, approach, or objectives. Financing business such as Fidelity helps you setting a trading and investing method otherwise control your assets for your requirements.

Investment steps

Do you want considerably more details now you understand using concepts and also have some cash to spend? The way to invest depends on your own personal tastes and you can monetary things. There’s a whole genre away from Tv shows making it come as if to find and turning a property is the modern equivalent out of alchemy. You would believe we have all the incredible power to change drywall and you may vinyl siding to the gold. Those who pick possessions looking to get rich brief should understand the risks. Paying small quantities of cash is a practice to get to the along with your currency could add up over go out.

To capture a complete matches in that condition, you would have to lead 6% of the salary annually. We are going to discuss those people professionals in more detail below, as well as four almost every other money alternatives. Funding banking institutions suggest exterior customers in a single division and trade the very own accounts in another.

How to Invest Money: A step-by-Step Guide

Shared fund give traders an inexpensive way to broaden — distribute their funds round the multiple investments — so you can hedge against any single investment’s loss. Strengthening a diversified collection away from private brings and you will securities takes time and you will options, so most traders benefit from finance investing. Index money and you may ETFs are generally reduced-costs and simple to deal with, as it might capture only four or five financing to build adequate variation. You will find a lot of money company that enable you to expend your bank account in the business tracking list ETFs.

Start Spending Very early, Continue Paying On a regular basis

- Because of this if an individual single industry endures a big drawback, they acquired’t block your entire collection.

- You will possibly not be able to buy a full time income-generating possessions, you could spend money on a pals one does.

- Due to this, inventory investing requires a reasonable number of lookup, lingering diligence and you may an abdominal to possess risk.

One to display price is simply the ETF’s financing minimum, and you can according to the money, it will range from below $one hundred to $three hundred or even more. Market list try a variety of investments one to depict a great portion of the market. For example, the fresh S&P five-hundred are a market directory one holds the brand new stocks from approximately five-hundred of the prominent enterprises on the U.S. An enthusiastic S&P 500 directory finance create seek to reflect the new overall performance out of the new S&P five-hundred, buying the brings in that directory.

When you have many years and you can ages before you you need your finances, you’re also generally within the a much better condition to recover from dips inside disregard the value. Determining just how much risk to take on whenever paying is called evaluating their exposure tolerance. For many who’lso are at ease with a lot more small-name highs and lows on the financing well worth to the options of better a lot of time-name efficiency, you probably provides higher risk endurance. Simultaneously, you might be more confident having a slow, much more moderate rate of return, that have less good and the bad. To purchase “physical” commodities function carrying levels of petroleum, grain and gold. As you might think, this isn’t how many people spend money on products.

The new questionnaire several months concluded a few days through to the Fed’s last Federal Open market Panel fulfilling of the season, where they signaled a slower rate from rates slices inside the 2025. Dollar-rates averaging (DCA) is an additional fundamental investment strategy one fundamentally comes to busting the newest swelling amount of cash purchased one company inventory to your lower amounts during a period of date. However, particular can get choose passive committing to repaired-money bonds generate more a lot of time-name passive income however, want quicker constant desire.